This post may contain affiliate links. Please read my disclosure for more info.

Successful investing isn’t easy to achieve. With the number of seasoned investors in real estate and the stock market, these markets are very efficient, leaving little to no arbitrage opportunities on the table.

However, because the markets are so efficient, most of the equities are fairly priced. This means that anyone with a little patience, discipline, and know-how can be successful.

Smart investors who want to achieve success learn and emulate others who have already experienced it.

Please keep reading to learn 13 common habits of successful long-term investors.

“It is not necessary to do extraordinary things to get extraordinary results”

– Warren Buffet

Set Clear Goals

To get where you’re going, you first need to have a destination in mind. Setting clear goals makes it easier to identify and communicate expectations for the investment.

If you’re a hedge fund seeking capital, how do you think a potential client is going to react if you can’t clearly identify the return on investment and how you plan to achieve it?

Even for personal investing, setting clear goals helps ensure you will target investment vehicles that will help you achieve your goals.

For instance, if your goal is to invest $5,000 per year and achieve an average rate of return of 10 percent on your investments for the next five years, it may not make sense to invest the $5,000 per year in US Treasury securities. You’ll most likely have to invest in riskier vehicles like real estate or stocks.

However, if your goal is to minimize risk and you’re not worried about losing money to inflation, it may make sense to invest in US Treasury securities.

Have an Investment Plan and Stick to It

Building off of the goals you made earlier, you should develop an investment plan to achieve your goals.

This should include:

- A funding plan – how much do you plan per month to achieve your goals? Will you use leverage to achieve your goals (i.e. margin, loans, etc.)?

- What investment vehicles will you use? – will you use real estate, stocks, options, bonds, etc. Make sure to consider the rate of return and risk when determining your investment vehicles

- For each investment vehicle, what specifically will be your strategy? –

- If you are targeting real estate, will you be looking to buy properties to flip or rent out? Are you targeting industrial, commercial, or residential property? Maybe a real estate crowdfunding platform?

- For stocks, is there a certain sector of the economy your honed in on? Certain size companies large cap, midcap, small cap? Value vs growth?

- For multiple investment vehicles, determine the mix you’d like to maintain – for instance, if you’re planning on investing in stocks and bonds, what mix of various stock and bond types do you want to maintain?

- For instance, you might target 40 percent large cap stocks, 20 percent midcap stocks, 10 percent small cap, 10 percent investment grade corporate bonds, and 20 percent treasury bonds. Changes to this mix will alter your rate of return and risk, so you should include plans to reallocate occasionally to keep this mix current

- Establish predetermined rules for withdrawal – this could be as simple as taking the money out when it loses a predetermined amount of value or leave it in for a long-term period regardless of current losses (i.e. buy and hold until retirement)

Prioritize Investing

Do not save what is left after spending, but spend what is left after saving.”

– Warren Buffett

You’ll never meet your investing goals if you don’t first invest. You went through the trouble of making a plan, why not follow it?

When making your monthly budget, prioritize your needs, then saving and investing, then everything else.

To prevent other categories from sabotaging your saving and investing budget categories, go ahead and pay yourself first.

In other words, take the money out of your paycheck for saving and investing prior to paying anything else, then, live off of the rest of the paycheck.

Invest on Autopilot

To make it even easier, automate the process of saving and investing.

In addition to investing directly into your work retirement, you can also split up your direct deposit, so that a portion of your paycheck automatically goes to investing accounts.

Another way to set this up is to setup an automatic withdrawal from your bank to your investment account.

Minimize Investing Expenses

“Beware of expenses: A small leak will sink a great ship.”

– Ben Franklin

Successful investors are ever-cognizant of the fees and expenses associated with investing.

If you’re a real estate investor and are using leverage (borrowed money/debt), shop around for the best terms. The less interest you pay and risk you take, the more money you’ll likely keep in your pocket.

For stock market investors, keep fees and expense ratios to a minimum.

For example, let’s say you have the choice between a managed mutual fund and an un-managed index fund. Both have a similar 10% rate of return before expenses over the previous 10 years. However, the managed mutual fund charges an expense ratio of 1% while the index fund only charges 0.2%.

If you would have invested $10,000 in the managed mutual fund 10 years ago, you would have ~$23,673.64. However, if you had invested in the index fund you would have had ~$25,469.67. This is a difference of ~$1,796.04 over just 10 years. The longer the time horizon, the more significant the impact due to compound interest.

Diversify Your Portfolio

“Diversification is not only the first important thing investors should think about, but the second and the third, and probably the fourth and fifth, too.”

– John Bogle

When it comes to investing there is typically a direct correlation between risk and rate of return. Risk comes in the form of market risk as well as other types of risk like industry risk, management risk, fraud, etc.

While market risk is more difficult to mitigate, the other types of risk are not. By diversifying your investments over a large portfolio of stocks in different industries, you effectively mitigate the negative affects of the risk (except market risk) associated with any one stock.

Stock Market

A great way to do this is to invest in an index fund like the Vanguard Total Stock Market Index (VTSAX). This index fund provides you with exposure to the entire U.S. equity market. At the time of this writing, that consists of 3,535 companies.

Market risk is a little more difficult to mitigate. A few ways to mitigate market risk for stocks includes:

- Put options – puts gain value as the price of the underlying security goes down. If you are invested in a particular security or securities that you believe may be at risk of falling in price, you can take out put options as a hedge.

- Volatility index indicator – the VIX measures the implied volatility of at the money calls and puts on the S&P 500 index. VIX rises during periods of increased volatility. In essence, it performs opposite the market as a whole. You can use ETFs or options to go long on VIX as a way to mitigate market risk.

Both of these can be more costly than just accepting and living with market risk. If you have a long-term horizon, it may be more beneficial to just stay invested through bear markets instead of trying to time the market or hedge against it.

In addition to diversifying in the U.S. equity market, you can also diversify by investing internationally. If you believe the highest returns can be found outside the U.S., it may be worth investing in an index fund that gives you broad exposure to foreign markets like the Vanguard FTSE All-World ex-US Index Fund (VFWAX).

Real Estate

This holds true for real estate as well. If you invest all of your money in one small area, when that area hits hard times, all of your properties will suffer. It’s better to diversify areas, sizes, type (industrial, commercial, residential), etc. to limit your exposure to any one market segment.

Also, if you primarily invest in real estate using one money-making strategy, you may want to consider adding other strategies to the mix to limit your exposure.

For instance, if you primarily buy properties to fix and flip, you may want to consider holding on to a few properties for rentals.

Respect Your Risk Tolerance

In addition to mitigating risk, you should understand your own risk tolerance and invest appropriately.

If you are extremely risk-averse and the thought of investing your money in stocks alone makes you sweat, then you probably shouldn’t do it.

Take some time to learn about yourself and uncover your investing and risk preferences.

Do you work as a real estate agent and feel more comfortable investing in real estate? Maybe you’re a financial advisor and valuing companies is more in your wheelhouse?

On the risk side, would you be ok with losing 20 percent of your money within a year’s time? 30 percent? 50 percent?

When you develop your investment plan, make sure to take your risk tolerance into account. Be true to yourself and develop a mix of investments that works for you.

Understand and Avoid Psychological Traps

There is a myriad of psychological traps associated with investing you should avoid like:

- Recency bias – this is a phenomenon where you judge things based on its most recent performance. For instance, let’s say you’re investing in individual stocks and notice that a stock has been a high performer for the year. It’s year-to-date rate of return is ~20% while the market as a whole has only returned ~15%. Because of its recent performance, you decide to invest in the stock. The stock experiences no market gains for the rest of the year, meaning you bought at the peak price for the year.

- Not selling an investment as planned – if part of your plan is to invest in stocks, you should have a valuation and exit strategy for each stock. It’s hard for us to sell losers because it means admitting we were wrong on an investment, but if you have a predetermined exit strategy, it should be easier to make that decision. On the flip side, if you have plans to sell at a certain value and your valuation is still current, follow your plan.

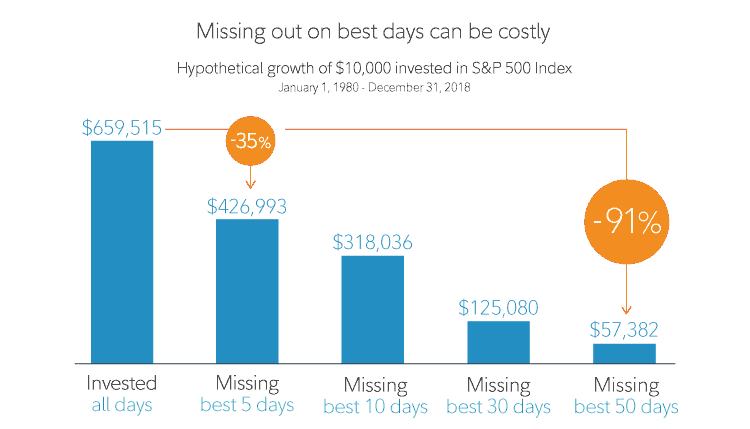

- Timing the market – In case you haven’t heard hit, don’t try to time the market. It’s near impossible and costly if you make a mistake. In this article by Fidelity, they show that just missing the best 5 days in the market between 1980 and 2018 would have caused you to miss out on 35% of your gains during this 38 year period (just five days!).

Maintain Realistic Expectations

When you’re developing your goals and plans, keep your expectations realistic.

For instance, according to NerdWallet, the historical average stock market return is 10% annually (not adjusted for inflation). If you’re investing in the stock market, it’s realistic to consider 8-10%. It’s not realistic to consider 20-25%. Sure, this kind of return has happened in the market in the past, but it’s much less likely.

If you have unrealistic expectations you are just setting yourself up for failure and disappointment.

Manage Your Portfolio (don’t micro-manage)

Even if you’re a long-term investor, it’s irresponsible to just continue pouring money into an investment account without at least checking it from time to time.

Many experts recommend checking your portfolios at least quarterly and re-balancing at least annually.

On the flip side, you can check it too much as well. If you’re a long-term investor, checking your account any more than monthly is probably overkill. Aside from it wasting your precious time, it can also cause you to make investing decisions based on recent information as opposed to taking a long-term view.

Persevere Through Market Ups and Downs

Investing will never go exactly as you planned it. Successful investors recognize that there will be peaks and valleys, especially in the short term.

The odds of success in the stock market and in real estate have historically gone up over time (i.e. the more years you’ve been invested, the greater the odds you’ve experienced positive gains).

Successful investors persevere through the rough times because they know success is most likely just on the other side of it.

Invest in the Market (for the long-term)

“Our favorite holding period is forever.”

– Warren Buffett

This one is probably the most obvious habit, but needs to be stated nonetheless. If you don’t invest, you won’t be a successful investor.

You need to put your money to work and keep it working for you. Historically, the longer you stay in the market, the greater your chance of success from investing.

Also, the longer you stay in the market, the more likely you’ll learn about your investment strategy. The more you learn, the better you’ll become at developing successful plans and strategies to reach your goals.

Withdraw Intelligently and Intentionally

When you’ve met your financial goals and it’s time to start withdrawing money, there are a few things you should consider:

- If you’re in a bear market, consider waiting to retire until after the market rebounds – timing the market is bad, but so is taking out a big chunk of money when your investments are at their lowest. If you can, it’s best to wait until they rebound and start your retirement then.

- Have a plan for withdrawing the money – you had a plan for building this portfolio, now you need a plan for withdrawing from it. If this is your retirement, consider withdrawing no more than 4% each year. The 4% rule of thumb is based on academic research and suggests that based off of historical returns between 1926 – 1976, if you withdraw no more than 4% each year, you should be able to live off of your investments through retirement. In the research, there was no period of time that resulted in the money lasting less than 33 years.

- As you approach retirement, consider squirreling away more money in cash and cash equivalents – as you get closer to retirement, it may make sense to put away some money in bank certificates, money market accounts, or other liquid accounts for your first few years of retirement. Those first few years can make or break how long your money will last, so having some cash or cash equivalents may be useful if you experience a downturn in the market right after retiring. You can replenish your cash from your investments when the market recovers.

- Re-balance your portfolio as you withdraw – once you start withdrawing, you’ll still need to check on your accounts routinely and re-balance annually to ensure your allocations don’t get out of whack.

13 Common Habits of Successful Long-Term Investors – Conclusion

Making money investing in real estate and/or the stock market can be difficult, especially if you don’t understand how important time is to the whole equation.

Your investment portfolio won’t be built in a day. It will most likely take years of hard work and perseverance.

If adopted, the 13 habits listed above should help you on your journey to reaching your financial goals.

What habits have you developed that led to investing success?