This post may contain affiliate links. Please read my disclosure for more info.

Are you at a point in your life where you’re itching to buy your first home? Maybe you have a baby on the way and are looking to upgrade? Well, if you have debt in your life (I’m assuming you do if you are reading this article), you are probably wondering, should I pay off debt or save for a house? Continue reading to discover the answer.

Table of Contents

Buying a Home is a Big Financial Deal

For most people, buying a home is the largest single purchase they’ll make. Not only do you need to save for a large down payment and fees associated with buying and closing on a property, but the monthly expenses are typically higher than renting because you’re now responsible for all maintenance and repair work, taxes, home insurance, etc.

Purchasing a House

Mortgage Application

When you apply for a mortgage, the lender will consider both your income and your debt payments when considering how much to lend you for a home.

43% Mortgage Lending Rule

As a rule, most mortgage lenders won’t qualify you for a mortgage if your debt-to-income ratio is more than 43 percent.

Your debt-to-income ratio is just as it sounds; your monthly debt payments divided by your monthly income.

For example, let’s say you pay $2,400 per month towards debts and make $8,000 per month in gross income. In this case, you would have a debt-to-income ratio of 30%

When calculating the 43% threshold, mortgage lenders also take into account your potential mortgage debt.

Using the previous example, lets see how large a payment you would be qualified for using the 43% rule. $8,000 X 0.43 = $3,440. Next, we take out the other debt payments – $3,440 – $2,400 = $1,040. In this example, a mortgage lender would approve you for a qualified mortgage, but only for a mortgage payment of no more than $1,040 per month.

The 43% mortgage lending rule is a maximum debt-to-income ratio for lending purposes. Just because a lender will qualify you for a mortgage, it doesn’t mean that you should take the maximum amount.

In addition, the 43% rule doesn’t take into account your other expenses each month (i.e. groceries, utilities, car expenses outside of loan, hobbies, entertainment, etc.).

What Percentage of Income Should Go To Housing?

28/36% Rule

Outside of hard and fast lending rules, there are also some general rules of thumb to help you determine how much mortgage you can afford. Many financial advisors agree that you shouldn’t spend more than 28 percent of your gross monthly income on housing expenses and no more than 36 percent on total debt (this includes other debt in addition to the mortgage).

You can calculate these the same way you did the 43% mortgage lending rule, debt divided by income. 28 percent rule = monthly housing expenses (mortgage debt, PMI, taxes, insurance, etc.)/monthly income; 38 percent rule = all monthly debt/monthly income.

Credit Score and Home Mortgage Financing

On top of debt being considered in your debt-to-income ratio, it will also affect your credit score. Your credit utilization makes up 30% of your credit score. The higher the ratio of current balance to original amount for loans, credit cards, etc. the more it hurts your score.

Even if your debt-to-income ratio is favorable, your debt may still be adversely affecting your credit score. This could cause you to have higher interest rates on your mortgage or be denied by the mortgage lender altogether.

Other Things to Consider

Is the House an Investment Property?

My personal preference is to shy away from additional financial risk, but when it comes to investments, sometimes fortune favors the bold.

If your options are saving money for an investment property or paying off debt, there are other variables you should take into account.

Will the property cash flow (income after all expenses are paid, including maintenance and repairs funds)?

Does the cash flow lead to paying off the debt faster in the long run (i.e. decreases debt-to-income ratio moving forward)?

Can You Avoid Private Mortgage Insurance (PMI)?

If you’re already under contract for a house or have otherwise committed to purchasing a home, it may be worth it to save money for a down payment versus paying off debt to avoid PMI.

If you put down less than 20% of the mortgage value, most mortgage lenders will require you to pay for private mortgage insurance (PMI). This can be hundreds per month depending on the price and your credit worthiness.

If you run the numbers and find that paying PMI will cost more in the long run than paying down the debt faster, it may be worth it to focus on getting the 20% down payment first.

Of course, the best way to handle this is to first pay down debt, then save up a 20% down payment, but I know each person is different. For some, the extra time in a home may be worth the extra costs.

Increase Down Payment to Obtain Better Mortgage Terms

Again, if you’re already under contract for a home or have otherwise committed to purchasing a home, it may be worth it to save money for a down payment versus paying off debt to getting better terms on the loan.

Even if you aren’t able to save 20%, saving even just 5% will give you much better interest rate than a zero-down loan would afford you. Just remember, the more you put down, the less risk the mortgage lender is taking and the less they should charge you for the mortgage.

If the amount you’ll save in interest rates is more than what you’d save by paying down the debt, then putting more down will be the better financial option.

Again, the best way to approach this scenario is to pay off the debt first, then save up at least 20% for a down payment, but if you’ve already committed to buying a home (i.e. signed a contract or equivalent), this could end up saving you thousands in the long run.

Could Renting Long Term be a Better Option than Buying a Home?

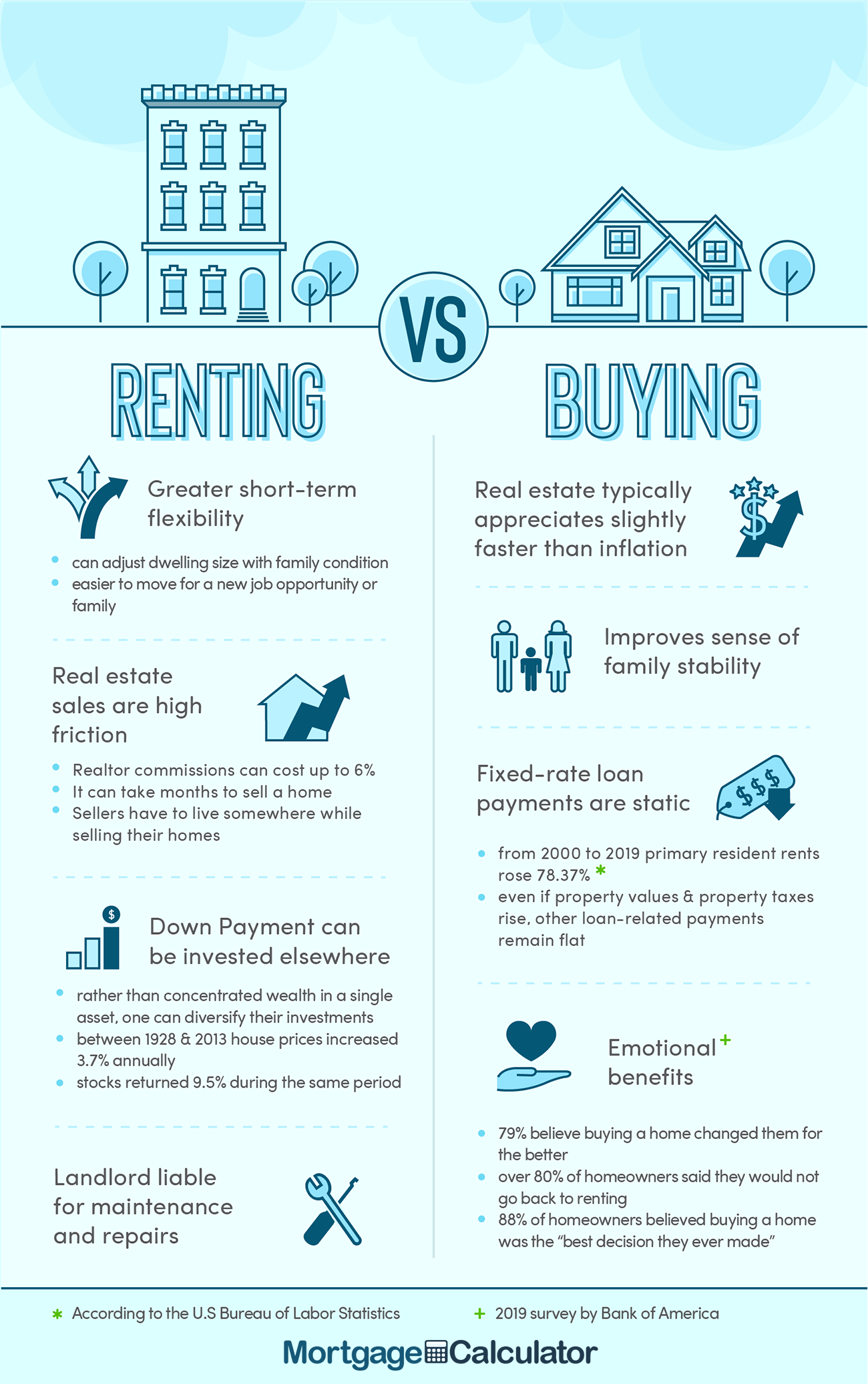

Please see below a great infographic from Mortgagecalculator.org that lists the pros of renting versus the pros of buying a house.

via MortgageCalculator.org

In addition, please see below a video from Khan Academy that tackles the importance of running the numbers for your individual situation. Different housing markets may favor renting versus buying a house.

Should I Pay Off Debt or Save For a House?

The simplest answer to this question is that paying off debt first will provide you with the greatest financial flexibility and provide the most advantageous terms (interest rate, amount you can borrow, etc.) on a home mortgage.

Because of these factors, paying off debt should typically come before saving for a house.

There is a price to be paid by paying off debt first; time. If you pay off debt first, it probably means you’re going to have to wait a little longer to save for a house.

When you’re ready to start looking for a mortgage, Bankrate has a great new house calculator you can use.

To use it, you just need your monthly income, monthly expenses, and an estimate of your housing costs and total down payment.

Once you hit calculate, it will give you an estimate of both mortgage payment and home amount you can afford based off of your inputs.

It uses a debt-to-income ratio of 36% to calculate these numbers.

Did you pay off debt or save for a house first? If you haven’t bought a house yet, do you plan to pay off debt first?